old town maine tax commitment|maine property tax rates by town : Bacolod Current Requests for Proposals for the City of Old Town; 2024 Council Agendas, . Check if Apptool.club is a scam or a safe website, check if Apptool.club is legit, read other customer reviews, discussions and complaints.

old town maine tax commitment,Real Estate Tax Commitment Book by Name - FY2023. 2022-2023 Tax Bills. 2021-2022 Tax Bills. 2020-2021 Tax Bills. 2019-2020 Tax Bills. 2018-2019 Tax Bills. 2017-2018 Tax Bills. City of Old Town, ME.maine property tax rates by town107 MAINE AVENUE BANGOR ME 04401 WEST OLD TOWN ROAD B5830P110 .

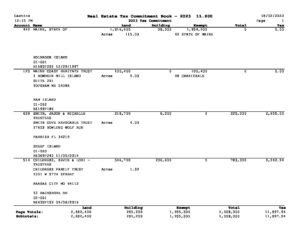

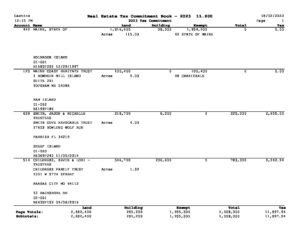

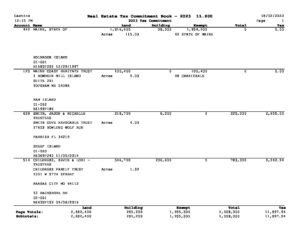

The City Assessor discovers, describes, and values all real and personal .Current Requests for Proposals for the City of Old Town; 2024 Council Agendas, .Find out how much you owe in property taxes for the fiscal year 2022 in Old .Old Town Real Estate Tax Commitment Book - 17.700 08/29/2023 AccountName & Address Land Building Exemption Assessment Tax 10:08 AM FY 2023-2024 Tax Bills .Old Town Real Estate Tax Commitment Book - 21.000 09/20/2022 AccountName & Address Land Building Exemption Assessment Tax 10:52 AM 2023 Tax Billing .OLD TOWN ME 04468 10 LEXINGTON DRIVE B13687P28 10/29/2014 6,612.49 Acres 1.27 030-004-000 Page 4 Hermon Real Estate Tax Commitment Book - 11.990 09/30/2021 .

00532 646 maine street properties 028-007 001 15,500 114,700 0 130,200 646 main street 00213 7 shree siddhi llc 025-025 001 14,800 118,100 0 132,900 . old town 10:01 am .old town maine tax commitmentThe City of Old Town City of Old Town - Tax Assessor Office is located in the Old Town Municipal Building building in Old Town, Maine. City of Old Town is a locality in .

Current Requests for Proposals for the City of Old Town; 2024 Council Agendas, Minutes & Videos; Departments. Airport; Assessor. . Tax Maps. Public Notices. Trash & Recycling. GIS Map. Library. Public Safety. Economic & Community Development. . 265 Main Street Old Town, Maine 04468 (p) 207-827-3965 | (f) 207-827-3979 .

OLD TOWN ME 04468 10 LEXINGTON DRIVE B13687P28 10/29/2014 6,612.49 Acres 1.27 030-004-000 Page 4 Hermon Real Estate Tax Commitment Book - 11.990 09/30/2021 AccountName & Address Land Building Exemption Assessment Tax 1:02 PM 2021 Tax Commitment Page Totals: 353,200 999,000 50,000 1,302,200 15,613.39 Subtotals: .Old Town Real Estate Tax Commitment Book - 17.700 08/29/2023 AccountName & Address Land Building Exemption Assessment Tax 10:09 AM FY 2023-2024 Tax Bills . 107 MAINE AVENUE BANGOR ME 04401 WEST OLD TOWN ROAD B5830P110 0.00 Acres 4.60 17 LITERARY & SCIEN 001-004 2630 GETCHELL LANCE R 30,700 .

World War II - 12/7/41 - 12/31/46. Korean Conflict - 6/27/50 - 1/31/55. Vietnam Conflict - 8/5/64 - 5/7/75. Desert Storm - 7/7/90 - 4/11/91. Application: Written application for the exemption must be made to the Assessing Department on or before April 1 of the year first seeking exemption. Forms are available at the Assessor's Office.

You can call the City of Old Town Tax Assessor's Office for assistance at 207-827-3960. Remember to have your property's Tax ID Number or Parcel Number available when you call! If you have documents to send, you can fax them to the City of Old Town assessor's office at 207-827-3966. Please call the assessor's office in Old Town before you send .

Steuben Real Estate Tax Commitment Book - 16.000 07/07/2021 AccountName & Address Land Building Exemption Assessment Tax 3:26 PM 2021COMMITMENT Page Totals: 443,100 0 0 443,100 7,089.60 Subtotals: 1,779,300 1,131,000 108,600 2,801,700 44,827.20 Land Building Exempt Total TaxCurrent Requests for Proposals for the City of Old Town; 2024 Council Agendas, Minutes & Videos; Departments. Airport; Assessor. . Tax Maps. Public Notices. Trash & Recycling. GIS Map. Library. Public Safety. Economic & Community Development. . 265 Main Street Old Town, Maine 04468 (p) 207-827-3965 | (f) 207-827-3979 .2022 Real Estate Tax Commitment Book: 705.77 KB: 2022 Personal Property Tax Commitment Book: 14.55 KB: . 477.52 KB: 2020 Personal Property Tax Commitment Book: 10.64 KB: GIS Map; Maine Assessment & Appraisal Services Inc. Maine Tax Return Forms; Maine Tree Growth Tax Law; Property Tax Stabilization Program; Tax Collector; .Bangor Real Estate Tax Commitment Book - 19.150 07/25/2023 AccountName & Address Land Building Exemption Assessment Tax 9:40 AM FY24 - RE & PP Page Totals: 574,100 2,408,500 0 2,982,600 57,116.78 Subtotals: 865,100 3,868,400 0 4,733,500 90,646.51 Land Building Exempt Total TaxThe City of Old Town City of Old Town - Tax Assessor Office is located in the Old Town Municipal Building building in Old Town, Maine. City of Old Town is a locality in Penobscot County, Maine. . Real Estate Tax Commitment Book ; City of Old Town Search by name, tax map id, account number or street address ;old town maine tax commitment maine property tax rates by townReal Estate Tax Commitment Information Town of Readfield, 8 Old Kents Hill Road, Readfield, Maine 04355 Phone: (207) 685-4939 Fax: (207) 685-3420 Email: [email protected] apply to the subsequent year tax assessment. See reverse for additional instructions SECTION 1: CHECK ; ALL THAT APPLY YES NO A. I am a legal resident of the State of Maine B. I have owned homestead property in Maine for at least the past 12 months.

NETR Online • Old Town • Old Town Public Records, Search Old Town Records, Old Town Property Tax, Maine Property Search, Maine Assessor

The City of Old Town is pleased to offer our residents the option to pay tax bills and sewer bills online. Please note, we use a third-party payment processor, Maine Payport, that will charge a 2.5% service charge on the transaction. The additional fee does not go to the City. This is the same service provider that is used when payments are .Home; Departments. Town Manager; Assessing. Applications; Business Personal Property; Dates to Remember; FAQ's; Maine Revenue Services; NextGen911 - AddressingCurrent Requests for Proposals for the City of Old Town; 2024 Council Agendas, Minutes & Videos; Departments. Airport; Assessor. . View our Online Payments information for links to pay taxes, sewer bills, vehicle registration. Our Schools. Old Town High School; . 265 Main Street Old Town, Maine 04468 (p) 207-827-3965 | (f) 207-827-3979 . Tax Due Dates: September 29, 2023 (first half) and March 29, 2024 (second half) Certified Ratio: 100%. Current Tax Rate: 8.68. Commitment Date: August 9, 2023. Assessor's Online Database. Property record cards and assessment information can be found using the Assessor's Online Database.

old town maine tax commitment|maine property tax rates by town

PH0 · willimantic tax bill

PH1 · where is old town maine

PH2 · old town me town office

PH3 · old town maine town office

PH4 · old town maine tax records

PH5 · old town maine tax bills

PH6 · map of old town maine

PH7 · maine property tax rates by town

PH8 · Iba pa